This gives deeper insight into what other companies are doing and how a company's operations compare. This is important because all figures needed to calculate the average collection period are available for public companies.

It tells how competitors are performing.

This is important as strict credit terms may scare clients away on the other hand, credit terms that are too loose may attract customers looking to take advantage of lenient payment terms.

#AR RECEIVABLE TURNOVER RATIO FULL#

Until cash has been collected, a company is yet to reap the full benefit of the transaction. This is important because a credit sale is not fully completed until the company has been paid.

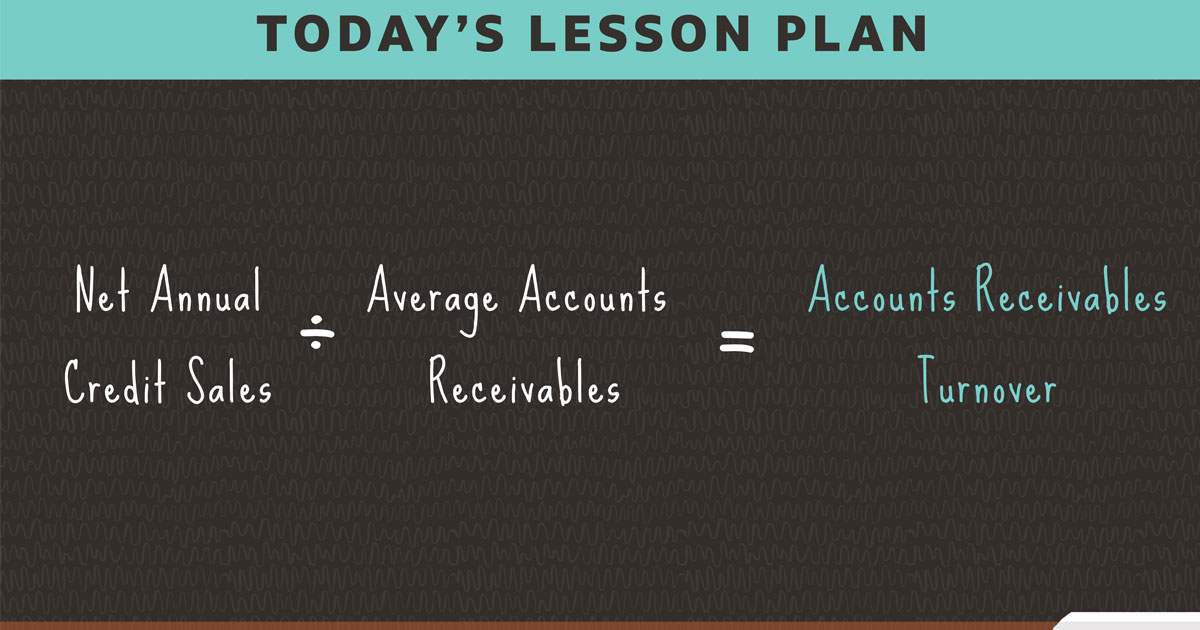

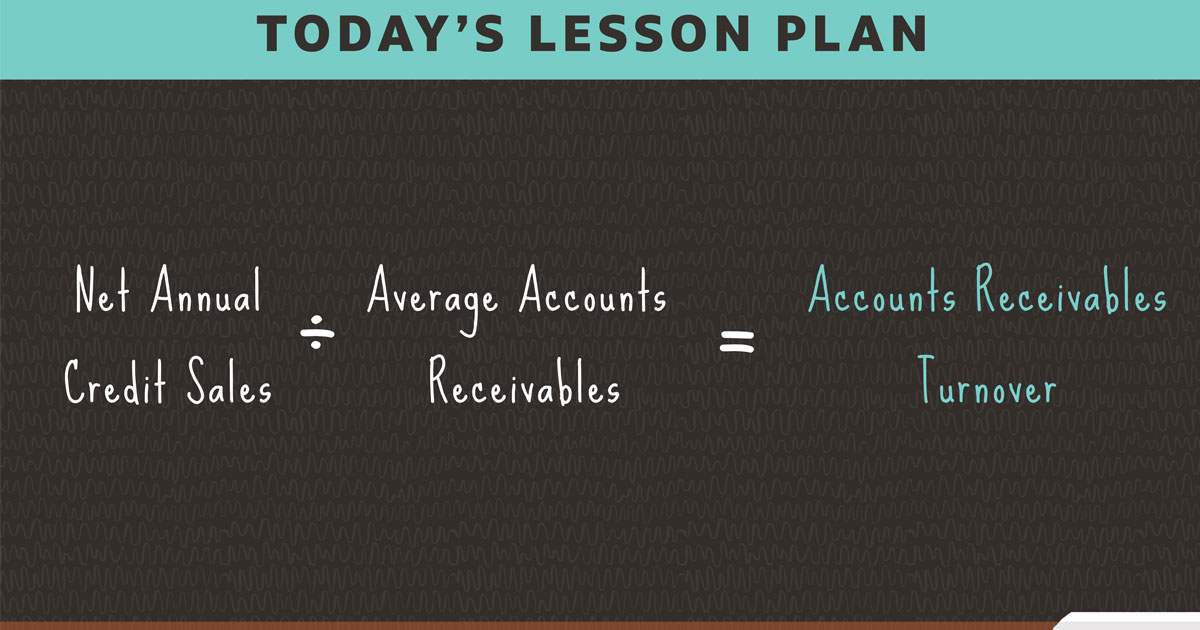

It tells how efficiently debts are collected. As such, they indicate their ability to pay off their short-term debts without the need to rely on additional cash flows. AR is listed on corporations' balance sheets as current assets and measures their liquidity. Companies normally make these sales to their customers on credit. A low average collection period indicates that an organization collects payments faster.Īccounts receivable is a business term used to describe money that entities owe to a company when they purchase goods and/or services. This period indicates the effectiveness of a company's AR management practices. The average collection period is determined by dividing the average AR balance by the total net credit sales and multiplying that figure by the number of days in the period. Companies calculate the average collection period to ensure they have enough cash on hand to meet their financial obligations. The average collection period refers to the length of time a business needs to collect its accounts receivables.

0 kommentar(er)

0 kommentar(er)